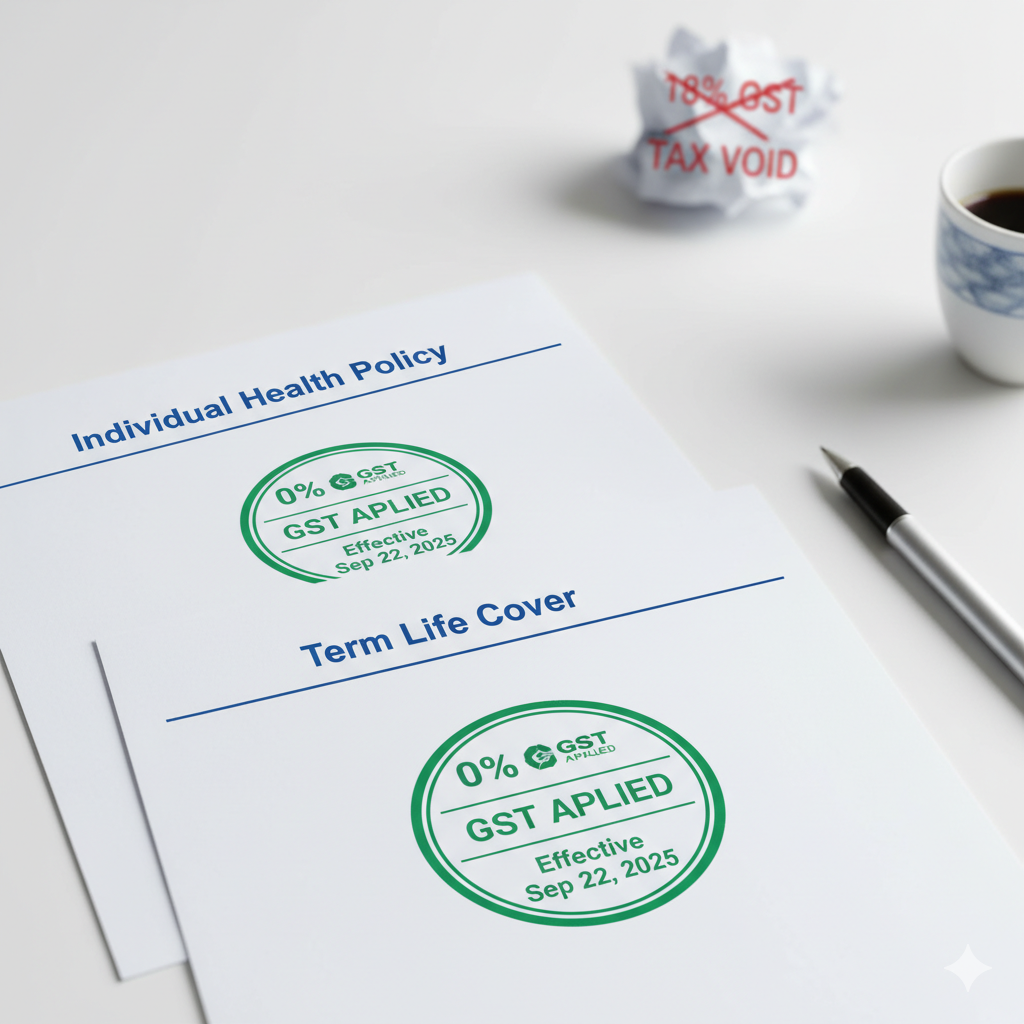

The government’s recent decision to exempt GST on individual health and life insurance premiums is one of the biggest wins for consumers in recent financial history. With the tax rate dropping from 18% to NIL, your premiums are instantly more affordable.

However, the exemption is specific. Use this checklist to confirm exactly which policies qualify for the 0% GST rate, and when the benefit applies to you.

1: The Three Policy Types That Are Now Tax-Free

The 0% GST applies specifically to protection products bought by individuals to secure their lives and health. This includes the following categories, effective September 22, 2025 :

| Policy Category | Examples Included |

| Individual Health Insurance | Standard health plans, family floater policies, and senior citizen plans |

| Individual Life Insurance | Term life plans, ULIPs (Unit Linked Insurance Plans), and Endowment policies |

| International Travel Insurance | Policies covering individuals traveling abroad |

2: Crucial Exceptions—Where GST Still Applies

Do not assume all insurance is exempt. The 18% GST rate remains applicable to:

- Group Insurance: Group life and group health policies, which are typically offered by employers to a collection of individuals.

- General Insurance: Major categories like Motor (car/bike), Home, and other property insurance still attract GST.

3: The Payment Date is the Golden Rule

The exemption is not based on your policy’s due date, but the date the payment is successfully processed.

- The 0% GST applies only to premiums paid on or after September 22, 2025.

- If your premium was due on September 21st, but you pay it on September 22nd or later, the 0% GST applied

- If you paid your premium before September 22nd, you are not eligible for a refund on the GST component already paid.

4: Revival of Lapsed Policies

The GST exemption provides an excellent opportunity to bring financial security back on track.

- If an individual life policy lapsed due to non-payment before September 22, 2025, any premiums paid to revive or reinstate that policy on or after the effective date will be exempt from GST.

Ready to protect finserv and secure your family’s future?

As expert consultants, we are monitoring all market adjustments to ensure you get the best product at the new, lower rate.